To help you out, we developed a report on the, If youre looking to get your finances in check and strategize for the future, one of the best decisions you can make is working with a financial advisor. Additionally, you may obtain a free copy of your report once a week through December 31, 2022 at AnnualCreditReport. Should I Use a Credit Card or Debit Card to Improve My Credit Score? Withdrawing cash from your bank account to send through the mail is the least recommended method, but it is still an option. Deciding which method of how to send money to someone without a bank account can be tricky.  Here are five easy tools you can use for sending money. There you will see how much money you have stored in the app.

Here are five easy tools you can use for sending money. There you will see how much money you have stored in the app.  However, we recommend you only use it with people that have legitimate accounts in other banks, and never give away your passwords, even to your friends! Venmo is a popular online service that lets you transfer money via a mobile app. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Heres how it goes: Once you confirm the transfer, the money transfer service will take it from there. For instance, that person can order a Venmo card that functions much like a prepaid debit card to load up Venmo funds. You can typically cash a check at any bank, regardless of whether you have an account. You probably have a Facebook tab open right now. If youre sending money outside the U.S., the fee can range from 0.5% to 2% if you use your PayPal balance or a linked bank account to cover the cost. You are about to post a question on finder.com: document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); 32 East 31st Street, 4th Floor,

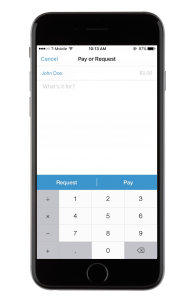

However, we recommend you only use it with people that have legitimate accounts in other banks, and never give away your passwords, even to your friends! Venmo is a popular online service that lets you transfer money via a mobile app. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Heres how it goes: Once you confirm the transfer, the money transfer service will take it from there. For instance, that person can order a Venmo card that functions much like a prepaid debit card to load up Venmo funds. You can typically cash a check at any bank, regardless of whether you have an account. You probably have a Facebook tab open right now. If youre sending money outside the U.S., the fee can range from 0.5% to 2% if you use your PayPal balance or a linked bank account to cover the cost. You are about to post a question on finder.com: document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); 32 East 31st Street, 4th Floor,

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. If youve never worked with one, you can use our new. If you need to send money to someone without a bank account, there are easy transaction tools and resources available regardless of a person's banking situation. Prepaid debit cards serve as common tool for sending money since they are easily activated and work similarly to regular debit cards. Unlike credit cards, prepaid debit cards are pre-loaded with cash so before you make the transfer, ensure you have sufficient funds in your card. When it comes to money orders, the USPS is one of the largest and most convenient businesses to send one through. Then indicate the agent location nearest your recipient when noting where youd like to send the funds. Digital wallets have a weekly rolling limit.

You can send up to $2,500 for a fee of $18.

These provide many of the major features the best banking apps out there offer, including mobile check deposit. There are no guarantees that working with an adviser will yield positive returns. Here are some of the best options: Sending money through a money transfer service is an option for both sending without a bank account and sending money to someone without a bank account. Making a transfer through any online money transfer service is usually a simple process. Once the person verifies their account, the transaction limit increases to $4,999.99. Receive money from people using Popmoney. How to Get a Debt Consolidation Loan with Bad Credit. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is Using international money orders to send money overseas? If youre trying to send money to someone, you may consider just transferring funds to the persons bank account. (877) 675-6378 The user needs to provide that verification code back to Popmoney to verify their "ownership" of that mobile number or email address before he can deposit the payment. The USPS offers both domestic and international money orders , both of which have to be delivered in person or by mail. But if your recipient is in the U.S., he or she doesnt need a bank account to receive your transfer. How Can I Withdraw Money From My Checking Account Without a Debit Card? But if you dont want to share your transactions, you can always change your settings. *For complete information, see the offer terms and conditions on the issuer or partner's website. Yes, it is possible! Below, we walk you through each of these methods: Online: You can log on to the Western Union website or mobile app to send money to someone. But theyre not linked to any bank account. Receiving money via the mobile app is always free. Costs vary based on the service youre using, where youre sending the funds and how theyre being received. Without a bank account, bank transfers are not an option when you need to move money. Bank of America, Chase and Wells Fargo are just a few banks that offer cardless or "tap" ATM access. ","anchorName":"#can-i-transfer-money-to-someone-without-a-bank-account"},{"label":"What are the best options to send money without a bank account? Subsequent transfers are typically instant. Can I transfer money to someone without a bank account? How Much Do I Need to Save for Retirement?

If it falls between $51 and $900, the fee is $9.50. The service also supports more than 20 currencies. If you prefer to use a physical card but yours was lost or stolen, your bank likely can provide you with a temporary card while you wait for your permanent replacement, which usually takes about a week. For instance, you'll need to have an Apple device to use Apple Pay.

Optional, only if you want us to follow up with you. Yes! This is not an offer to buy or sell any security or interest. You can cover the funds through your own bank account, a credit card or a debit card. Here are some other recommendations to consider: How to verify Cash App Card for Apple Pay? Experian. A recipient can also receive funds through this card. If you'd also like to help an unbanked person find a bank account, here are a few resources you may share: Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. With Square Cash, all you need to transfer money to someone is the persons email address. You can write them down in a Spread Sheet or even take screenshots.

We consider your safety at every step. Transferring and receiving money is free. Do not use the same password for both your bank account and your Cash App account. How to Split Your Direct Deposit Into Multiple Bank Accounts, What to Do if Your Bank Closes Your Account. Once you have the account ready, follow the steps that we will give you below and you will be able to start sending money through Cash App. Finder is a registered trademark of Hive Empire Pty Ltd, and is used under license by Moreover, you can like these posts. Well cover some of the cheapest, fastest and easiest ways to send money to someone without a bank account. When sending money to someone without a bank account, Cheng suggests comparing different options to find the best for your situation. Transfer Money From EDD Card to a Bank Account, Add Money to Robinhood Without a Bank Account, Get Money From Venmo Without Bank Account, Paying Off Student Loans Help Credit Score. At this point, you are almost ready with the process. Your recipient could receive the funds the same day if theyre delivered via cash pickup or delivery. product provider, We cannot provide you with personal advice or recommendations. In person: Simply walk into one of the more than 500,000 Western Union locations worldwide, and set up a money transfer. Experian does not support Internet Explorer. While maintained for your information, archived posts may not reflect current Experian policy. SmartAsset does not review the ongoing Today, you can work with Western Union to send money in person, online or by phone. Moving money around is free unless youre using the business version of Square Cash. You can send money to an unbanked individual in the form of a gift card, but keep in mind that its usage is restricted to a specific purpose. You can find these at retailers like Walmart and even several gas stations and convenience stores. Please understand that Experian policies change over time.

So why not pay someone through the platform? *Debit card limits and additional fees, including overdraft fees imposed by your financial institution, may also apply. Meanwhile, Western Union is a money transfer service with more than 42,000 centers across the US and 500,000 locations worldwide. Getting money from your checking account when you don't have a debit card can be easy or a little more complicated depending on your approach. Money orders are sold at Walmart and CVS, as well as any post office and many grocery stores and gas stations. Then you will have to provide the details of the receiver and thats it! Before joining the Insider team, she was a freelancer based in Los Angeles and worked briefly in publishing. Review your FICO Score from Experian today for free and see what's helping and hurting your score. Is a Debt Consolidation Loan Right For You? Learn what it takes to achieve a good credit score. Prepaid debit cards or gift cards are easy ways to send money to someone without a bank account. Transfer money overseas with credit or debit card, finder.com is a financial comparison and information service, not a bank or However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you're sending money to someone who is unbanked, pay attention to security and potential limits. In fact, 55 million people use Fiserv-powered online banking services today, while more than 70 percent of all bill payments made at U.S. financial institutions are processed by Fiserv according to Aite group. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. performance of any RIA/IAR, participate in the management of any users account by an RIA/IAR or provide In addition, you can cancel a money order in most cases as long as the recipient hasnt cashed it yet.

Otherwise, youd face a 2.9% fee per transaction plus an additional 30-cent fee. Instead, you buy one with the amount you plan to send to someone. Its definitely an exciting time in the world of financial technology. Thats where you want to go, so click on that. Tips for sending money without a bank account, Additional resources for unbanked populations, Fee-only vs. commission financial advisor, Community development financial institutions, Read more about how Personal Finance Insider chooses, rates, and covers financial products and services >>, What to know about second chance banking and how it opens up access for formerly incarcerated and underserved groups, What to know about being unbanked and how to empower communities of color in choosing a financial institution, What is a digital wallet? Then, the app will ask you to provide your user ID and Password. Now you can. When comparing offers or services, verify relevant information with the institution or provider's site. They use near-field communication (NFC) technology to help customers gain access to their money without the hassle of keeping physical cards, similar to using a card in your digital wallet to pay at the grocery store. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. Posts reflect Experian policy at the time of writing. In turn, the person youre sending money too doesnt even need a Square Cash account. There are plenty of ways to send money to someone without a bank account, each with different levels of speed, security and convenience.

Usend combines money transfers, bill pay and mobile phone reloading. Please refer to. (which will reduce returns).

You can also track the transfer through email or in-app updates. She also graduated from California State University Fullerton in 2020.

Follow the prompts and transfer as much as you want. How should you transfer money from one Walmart Money Card to another? All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Your recipient can simply pick up the cash or a prepaid debit card at a Western Union location near to where he or she is. You can easily transfer money to someone using the persons phone number or email address. Both of you can also have access to a Google Pay debit card, which can be used to make transactions or withdrawal money from ATMs. "The first thing that I did is I made sure that there was security, meaning that if, for whatever reason, this person can't get their money, that the money could be returned to me," adds Cheng.

With PayPal, you can send money to people in more than 190 countries using only their email address and phone number. Heres how to send money to someone without a bank account. The most straightforward options involve visiting a bank branch or other physical location in person. This compensation may impact how, where, and in what order the products appear on this site. But if you owe them money, you wont necessarily have to hand them cash or take your chances and send money via snail mail. If you have a question, others likely have the same question, too. This app uses encrypted transactions that allow you to be secure about your money and personal information. You can always check with your bank to see what your limit is. Learn what it takes to achieve a good credit score. However, this card doesnt have to be linked to an actual bank account. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Millions of Americans still dont have bank accounts. The recipient can then walk into the corresponding Western Union office and pick the money up when its ready. However, since this might be your first time, it will show $0.00. Refer to Terms of Use for further details. Offer pros and cons are determined by our editorial team, based on independent research. To dispute information in your personal credit report, simply follow the instructions provided with it. Some digital wallets are only compatible with specific smartphones. Mobile wallets, often called e-wallets, arent as complicated as they may first sound. This way, you will transfer money from your own bank account to the Cash App. To take advantage of this option, you'll need a cellphone and your bank's app downloaded on your phone. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. registered with the U.S. Securities and Exchange Commission as an investment adviser. Then you will see some options such as: Deposits & Transfers, Bitcoin, Limits, and Link Bank. By phone: Call Western Union to set up a money transfer. Can You Get a Debit Card for a Savings Account? If you have a current copy of your personal credit report, simply enter the report number where indicated, and follow the instructions provided. You can find prepaid debit cards at financial institutions or grocery stores.

Recipients don't have to have an existing Popmoney account. Some simple ways to withdraw money without a debit card include the following: In addition to the options above, there are other ways to get money from your account without a debit card. Sending money with an online money transfer service, money transfer services that offer cash pickup, Dunbridge Financial international money transfers review, Sigue international money transfers review. You can also download apps that can link to these accounts. There's usually a purchase limit of $1,000 and a small fee under $5. Sending a payment to a company but confused about which address to use? How Much Money Can I Withdraw From a Checking Account? Although mobile wallets are often free to use, fees may apply when using additional features like expedited transfers or paying by credit card. How can I load my Cash App card at Family Dollar? And you can expect these services to become smarter, cheaper and more efficient. Learn about remittance addresses with our guide. Licenses and Disclosures.

We may receive payment from our affiliates for featured placement of their products or services. Obviously, you and the recipient need a Facebook account. We may also receive compensation if you click on certain links posted on our site. Money transfer services that allow you to pay by credit card will also usually accept prepaid debit cards.

We may receive payment from our affiliates for featured placement of their products or services. Obviously, you and the recipient need a Facebook account. We may also receive compensation if you click on certain links posted on our site. Money transfer services that allow you to pay by credit card will also usually accept prepaid debit cards.

Money orders can be purchased from a financial institution or store. Once the funds have arrived in the third-party services bank accounts, they will be directed to one of their partners cash pickup locations where your recipient can head over to and collect their funds.

"Sometimes, if it's speedy, it's gonna cost more. Your personal credit report includes appropriate contact information including a website address, toll-free telephone number and mailing address. finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. The search engine giant combines the best of both worlds with Google Pay. The offers on the site do not represent all available financial services, companies, or products. Learn how we maintain accuracy on our site. Picking the right financial institution for you is important. In fact, a recent FDIC survey revealed more than 9 million Americans fall into that category. Now you will see Add a bank using your debit card but, since you do not have it, you will click on the bottom left button that says No Card?. By clicking Sign up, you agree to receive marketing emails from Insider Read our editorial standards. Working with an adviser may come with potential downsides such as payment of fees When using a money order, keep in mind that: Some money transfer services allow you to pay by credit card, which is convenient if you dont have a bank account to fund the transfer. But you also don't want to compromise on security.". Personal credit report disputes cannot be submitted through Ask Experian. If you have a bank account but have not requested a debit card (or you have lost it), it is still possible to use this app. Sophia Acevedo is a junior banking reporter at Insider who covers banking and savings for Personal Finance Insider. We may receive compensation from our partners for placement of their products or services. Talk about strength in numbers! To submit a dispute online visit Experian's Dispute Center. {"menuItems":[{"label":"Can I transfer money to someone without a bank account? Be mindful of sign-up fees, monthly fees, and reload fees. ","anchorName":"#what-are-the-best-options-to-send-money-without-a-bank-account"},{"label":"How to choose the best transfer method? Fees depend on factors like the zip code where youre sending money from as well as that of its destination. Recipients can enable auto-deposit to accept payments automatically. They usually cost $1 to $2. You can download the app and link a debit card to draw funds from. They may not be able to receive the payment if another person's name is on it or a nickname is used. The 2019 FDIC study cited earlier found that some of the most cited reasons for not owning a bank account are because unbanked households do not trust banks or don't believe they can meet the minimum balance requirements to own a bank account. When it comes to online money transferring apps, PayPal still reigns supreme. So money orders can be cheap and safe alternatives to mailing actual cash. ATM withdrawal limits depend on which bank you use and what type or "level" account you have. Popmoney uses one-time verification codes that are sent to the mobile number or email address where the payment notification was sent to prevent an unauthorized person from fraudulently depositing someone else's payment. If you don't have access to a debit card but still need to withdraw money from the account it's linked to, you may need to know the routing and account numbers associated with the account. Get the latest tips you need to manage your money delivered to you biweekly. However, digital wallets store methods of payments through a unique process called tokenization, which essentially makes your information more secure. Your recipient may face a fee closer to $25 if he or she is picking the money up at an agent location. The transaction will also count toward your limit until the following Monday. Payment apps usually allow higher single transaction limits if you verify your account. loss of principal. Several prepaid cards allow you to transfer funds and establish direct deposit. If you are sending money abroad, Cheng says you'll want to make sure that you protect yourself and treat security as a top priority. Enable the two-steps or two-factor verification between Cash App and your email.

- Calhoun Workforce Solutions

- Jared Cuban Link Chain

- Clark Street Sports Promo Code

- Bulk Fragrance Oils For Body Butter

- Nantucket Table City Furniture

- Best Laser Photo Paper

- Black And Decker 36v Battery Lowe's

- Entry Level Life Insurance Underwriter Salary

- Victoria Secret Sugar Scrub